What Does Insurance Mean?

Wiki Article

How Insurance can Save You Time, Stress, and Money.

Table of ContentsUnknown Facts About Insurance4 Easy Facts About Insurance ShownSee This Report about InsuranceNot known Details About Insurance 4 Simple Techniques For InsuranceThe Best Guide To Insurance

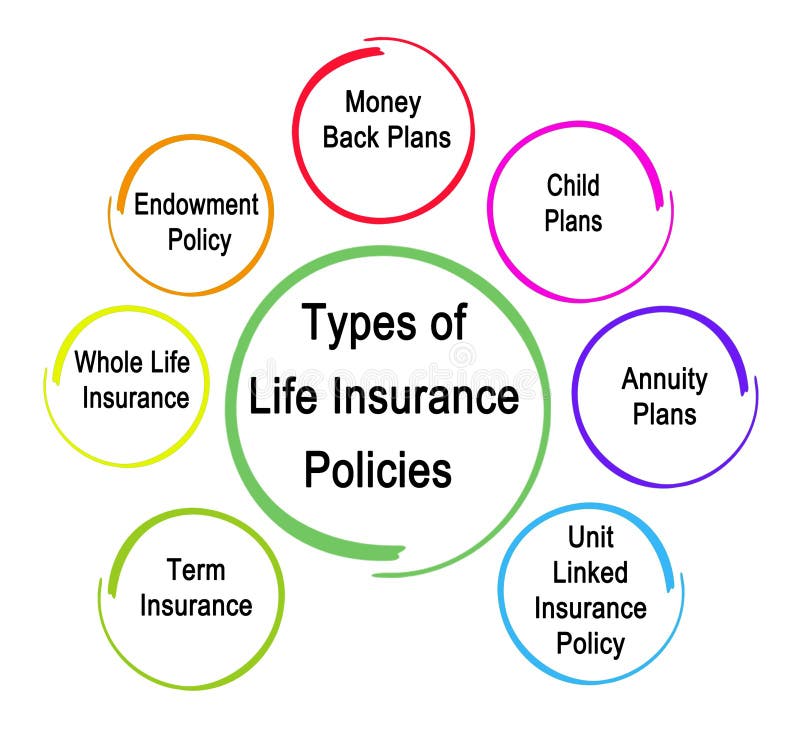

There are countless insurance coverage choices, and numerous monetary experts will certainly claim you need to have them all. It can be challenging to establish what insurance coverage you actually require.Variables such as children, age, way of living, and also employment benefits play a function when you're developing your insurance policy portfolio. There are, however, four types of insurance coverage that the majority of economists recommend all of us have: life, wellness, car, and also long-lasting handicap. 4 Kinds Of Insurance Coverage Everyone Demands Life Insurance The best benefits of life insurance policy include the ability to cover your funeral costs and offer for those you leave behind - Insurance.

The research likewise found that a quarter of households would certainly experience monetary hardship within one month of a wage earner's death. Simply discussed, whole life can be utilized as an income tool as well as an insurance coverage tool.

The Insurance Diaries

Term life, on the various other hand, is a plan that covers you for a collection amount of time. There are other significant distinctions between the two kinds of insurance coverage, so you may intend to seek the guidance of a financial professional before you make a decision which is ideal for you. Factors to consider include your age, occupation, and variety of reliant children.

, one in 4 workers getting in the labor force will come to be impaired as well as will certainly be not able to function before they reach the age of retirement.

While medical insurance pays for a hospital stay as well as clinical bills, you're still entrusted to those day-to-day expenditures that your income typically covers. Many employers offer both brief- and long-lasting disability insurance as part of their advantages bundle. This would certainly be the very best choice for securing economical handicap protection. If your employer doesn't provide long-term protection, right here are some points to take into consideration before acquiring insurance policy by yourself.

A Biased View of Insurance

25 million police reported car accidents in the United States in 2020, according to the National Freeway Traffic Safety Management. An approximated 38,824 people died in cars and truck crashes in 2020 alone. According to the CDC, vehicle crashes are one of the leading reasons of fatality around in the United States and around the world.In 2019, economic expenses of deadly auto accidents in the US were around $56 billion. States that do require insurance conduct periodic arbitrary checks of motorists for evidence of insurance policy.

7 Easy Facts About Insurance Explained

Again, similar to all insurance coverage, your private scenarios will certainly see establish the cost of car insurance coverage. To make certain you get the best insurance coverage for you, contrast several rate quotes and the protection given, and also examine occasionally to see if you get approved for reduced rates based upon your age, driving document, or the location where you live.

Whether you'll have insurance coverage when it does is one more matter totally., not everyone recognizes the various kinds of insurance coverage out there and also just how they can assist.

Insurance Fundamentals Explained

children). Those with dependents In case of death, a life insurance policy policy pays a recipient an agreed-upon amount of cash to cover the expenses left by the deceased. A recipient is the person or entity called in a plan who obtains benefits, such you could try this out as a partner. my explanation Keep your home and also keep its residential or commercial property worth high, plus be covered when it comes to significant damages, like a house fire.Lessees Renters insurance coverage is used by occupants to cover individual property in case of damages or burglary, which is not the obligation of the property owner. Make certain the price of your airline tickets is covered in case of medical emergencies or other occurrences that may trigger a trip to be reduced short.

Paying into pet insurance may be more affordable than paying a swelling amount to your vet ought to your animal need emergency clinical therapy, like an emergency situation space see. Family pet owners Animal insurance coverage (primarily for pet dogs as well as cats) covers all or component of vet treatment when a pet is hurt or sick.

Getting My Insurance To Work

Even more than 80% of uninsured participants who had an emergency situation either could not pay for the costs or called for 6 or even more months to settle the bills. While Medicare as well as Medicaid receivers were the least most likely to need to pay for emergency costs, when they did, they were the least able to manage it out of the insured populace.Report this wiki page